how are property taxes calculated at closing in florida

Divide the total monthly amount due by 30. Call us Today at 954 458-8655.

Free Printable Checklist For 1st Time Home Buyers 17 Critical Steps First Home Checklist Home Buying Checklist Buying First Home

This means essentially that if your closing takes place anywhere between January and the first week of November the amount of the current years property taxes will be unknown.

. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed. For a more specific estimate find the calculator for your county. Divide the total annual amount due by 12 months to get a monthly amount due.

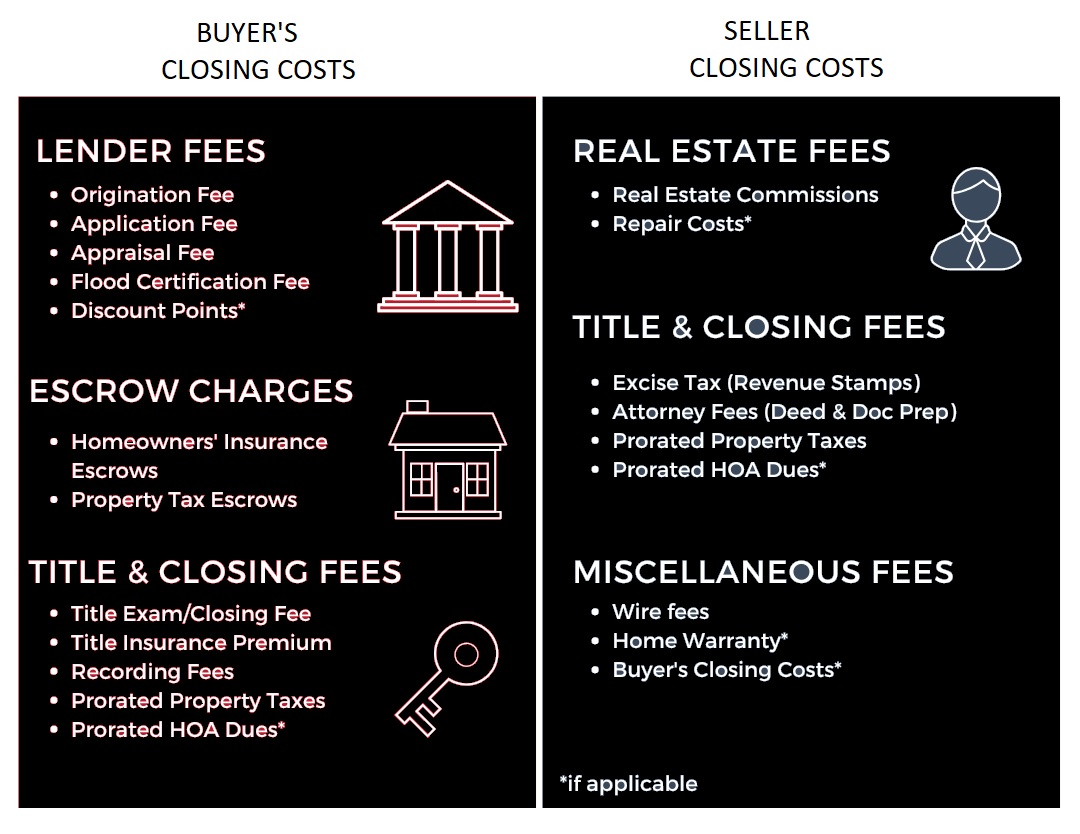

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. In Florida real estate taxes are paid in arrears. Closing costs are a collection of fees dues services and taxes that are split between the buyers and sellers of real estate property and cover the additional expenses related to real estate transaction that are not included in the sales price.

Frequently asked questions about Florida Real Estate Closings by Larry Tolchinsky Esq. County Taxes January 1 to May 1. Here is an example assuming a Closing on March 1 2018 for a property actually selling for 465000 having a Taxable Value of 325500 and having gross Total Taxes Assessments of 445216.

Assume Property B has an assessed value of 200000. Property taxes are one of the oldest forms of taxation. The report goes on to state that counties in Florida collect an average of 097 of a propertys assessed fair market.

Florida currently ranks number 23 for the amount of property taxes collected. With the median home price in Florida at about 355000 sellers in the state can expect to pay about 2485. This is the amount of prorated tax the seller owes at closing.

Calendar Year taxes 1117 123117 411775 Ad Valorem Taxes. While the nationwide average property tax rate is 11 of the average home value Florida counties collect an. The actual amount of the taxes is 477965.

4200 12 350 per month. Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing. Property owners have 2 years from the date taxes become delinquent April 1st before they risk loss of the property.

Plus the state is still ranked as the 23rd in the nation in terms of the average amount of property taxes collected. The average property tax in Florida is an annual 173300 considering a home worth a median of 18240000 in value. This is why property taxes are based on the previous years tax amount.

The taxes are assessed on a calendar year from Jan through Dec 365 days. In Florida property tax proration divides taxes between buyers and sellers and sellers. The real estate taxes for Property B are equal to 2000001000 x 215570 431140.

Youll pay around 16 of your homes final sale price in seller closing costs when you sell a home in Florida. For example for a closing occurring on May 1 the prorations will be labeled like this on a settlement statement. Though all the taxes fees lender charges and insurance add up generally neither party pays 100 of all the closing costs.

Prorate the taxes if necessary. For example in St. - Real Estate Attorney with 25 yrs of exp.

16291 Sarasota County Fire Rescue a Non-Ad Valorem assessment 428066. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day. This estimator is based on median property tax values in all of Floridas counties which can vary widely.

Everywhere in Florida outside of Miami-Dade County its calculated at 60 cents per 100 of the value on the deed. Multiply the total number of days by the daily tax amount. Since the closing date does not line up to the exact date a property tax bill is due the property taxes are pro-rated between the buyer and seller based upon the.

Instead the seller will typically pay between 5 to 10 of the sales price and the buyer will pay between 3 to 4 in. 16291 Sarasota County Fire Rescue a Non-Ad Valorem assessment 428066. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Real Estate Agent Commission typically 5-6 of the sales price. Closing costs can include among others costs related to due diligence. At closing the parties usually sign a re-proration Agreement agreeing to re-calculate the taxes owed.

As stated in Florida Statute 197502 after the 2 year period has elapsed and taxes remain unpaid the certificate holder may file a. Florida is ranked number twenty three out of the fifty states in. Lets look at the 2015 Ad Valorem taxes in detail.

Heres how to calculate property taxes for the seller and buyer at closing. This proration accounts for the time that the Seller still owned the property. For a 367175 home the median home value in Florida youd pay around 5952.

For the Florida median home value of 252000 this comes to 1512 outside of Miami-Dade or 1764 inside Miami-Dade. Coletti explains that in most of the state the tax is calculated at 007 multiplied by the purchase price or 070 per 100. The median property tax on a 18240000 house is 191520 in the United States.

What are closings costs. In most cases your closing costs will come out of your sales proceeds but theyre only a portion of what youll pay at closing. How much are closing costs in Florida.

350 30 1167 per day on a 30-day calendar. The seller is responsible for 6. In fact the earliest known record of property taxes dates back to the 6th century BC.

Tax amount varies by county. The median property tax on a 18240000 house is 176928 in Florida. Assigned millage rates are multiplied by the total taxable value of the property in order to arrive at the property taxes.

However in Miami-Dade County the rate is slightly lower at 006 times the purchase price or 060 per 100. Using the same example 35 per day for 104 days equals 3640. Determine the sellers amount due.

Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. Petersburg Florida the millage rate for 2019 is. 097 of home value.

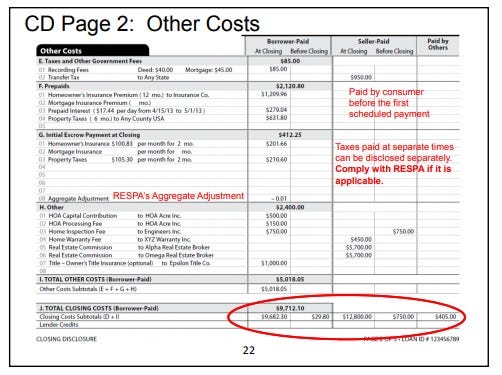

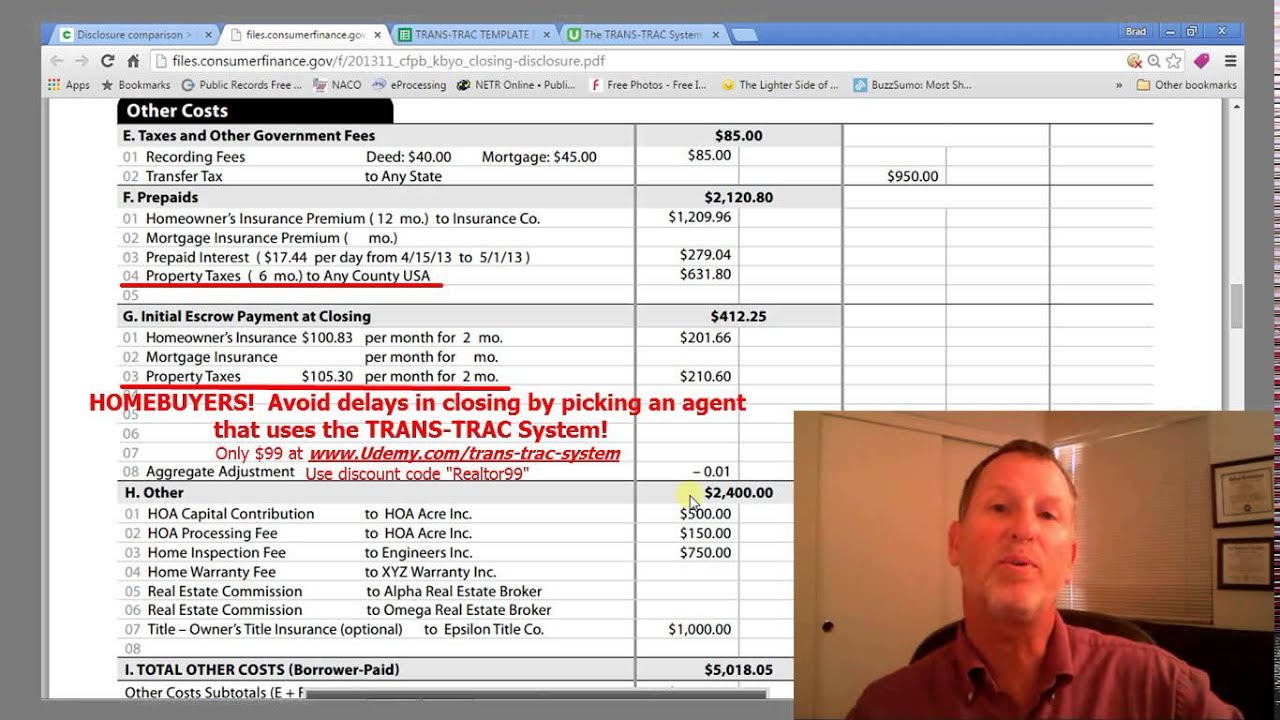

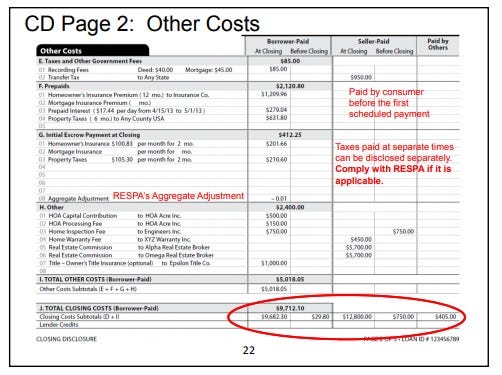

Property Taxes Explained On Closing Disclosure Youtube

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

Your Guide To Property Taxes Hippo

Closing Costs In Florida What You Need To Know

9 Hidden Costs Of Buying A Home Fidelity Home Buying Buying Your First Home Home Buying Process

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

How To Calculate Property Tax Prorations Ask The Instructor Youtube

Understanding Property Taxes At Closing American Family Insurance

Closing Costs That Are And Aren T Tax Deductible Lendingtree

1sttimehomebuyers Home Buying Credit Card Realistic

Your Guide To Prorated Taxes In A Real Estate Transaction

Your Guide To Property Taxes Hippo

Closing Costs Calculations Practice Video Lesson Transcript Study Com

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buyers Home Buying Real Estate Buying

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

First Time Home Buying From A First Time Home Buyer Buying First Home Home Buying Process Home Buying